Oil futures: Crude surges to fresh highs on geopolitical tensions

Quantum Commodity Intelligence – Crude oil futures Friday surged to fresh 2024 highs as an escalation in geopolitical tensions lifted weekly gains to over 5%, amid volatile trading heading into the weekend.

Front-month Jun24 ICE Brent futures were trading at $91.30/b (1825 GMT), compared to Thursday's settle of $90.65/b, and having peaked at $91.91/b which was the highest level since the spike in October following the Hamas attack on Israel.

At the same time May24 NYMEX WTI was trading at $87.01/b, versus Thursday's settle of $86.59/b.

Fears over a wider Middle East conflict have increased since Israel's attack on Iran's consulate in Damascus earlier this week, with Iran vowing to retaliate.

Escalating tensions came as the Central Intelligence Agency (CIA) cautioned Israel that Iran could launch a its own drone attacks, with the warning coming after Iranian President Ebraham Raisi said that the Damascas attack "will not remain without answer."

Meanwhile, the growing humanitarian crisis has led to Washington potentially reviewing its policy regarding the war in Gaza if Israel does not implement a series of concrete measures to address the impact on citizens, including steps for a ceasefire.

President Joe Biden "made clear the need for Israel to announce and implement a series of specific, concrete and measurable steps to address civilian harm, humanitarian suffering and the safety of aid workers," according to a White House statement.

Prices also strengthened Friday on the back of robust employment data from the US, with more than 300,000 jobs added in March.

At last week's pre-holiday Thursday close, Jun24 Brent futures closed at $87/b, while May24 WTI settled at $83.17/b.

Russia

Meanwhile, ongoing Ukrainian drone attacks may have disrupted more than 15% of Russian capacity, a NATO official said on Thursday, while US Secretary of State Antony Blinken said that more support is urgently needed for Ukraine following meetings with NATO foreign ministers.

According to Bloomberg, the US has not been able to persuade Ukraine to halt attacks on Russia's infrastructure, while Moscow has been targeting Ukraine's infrastructure since the 2022 invasion.

Analysts have said that both oil and gas supplies are likely to be impacted, including Goldman Sachs Thursday flagging potential disruptions to gas supplies next winter.

Last week the FT reported that Washington is also concerned that further drone strikes could push Russia into targeting Western interests, such as the CPC pipeline that is used by US majors Exxon Mobil and Chevron.

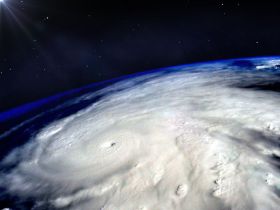

Meanwhile, forward prices were given a further lift after the Colorado State University (CSU) predicted a highly active 2024 Atlantic hurricane season, fuelled by the impending La Niña weather system.

CSU is forecasting 23 named storms, including 11 which are expected to become hurricanes and five that could reach major hurricane status.