Oil futures: Crude retreats 3% as focus switches back to negative indicators

Quantum Commodity Intelligence - Crude oil futures Thursday came under heavy selling pressure as recessionary and demand fears got the better of the more upbeat indicators, including possible SPR buying from the US government and China's megacity Chengdu lifting restrictions.

Front month November ICE Brent futures were trading at $91.37/b (1705 GMT), compared to Wednesday's settle of $94.10/b.

At the same time, October NYMEX WTI was trading $85.70/b versus Wednesday's settle of $88.48/b.

Opinions among analysts were divided amid the mixed pricing signals, although most expect prices to remain volatile going forward as the firmer dollar and next week's likely sharp rate hike from the US Federal Reserve proved a drag on markets.

"Demand concerns continue to weigh on oil prices: The oil market is telling a clear story that physical tightness has waned. Spot prices have fallen, forward curves have flattened, physical differentials have come in, and refining margins have weakened," said investment bank Morgan Stanley said in a client note.

Prices also retreated after US rail unions called off a proposed strike action.

The strike was set to have a devastating effect on US manufacturing and potentially the wider economy, including far-reaching consequences for the oil sector, which is also highly reliant on the rail transport network.

Oil started the day higher after local authorities said Chengdu will lift full lockdown restrictions Thursday in districts still facing curbs, indicating that the recent outbreak has been brought under control. Some districts in the 21-million metropolis started to exit full lockdown last week.

However, the IEA maintained its downbeat prospects on China for the rest of the year, forecasting the biggest drop in China's oil demand for three decades.

The energy watchdog said global oil demand growth would slow to a halt by the end of the year on a faltering global economy, especially in China, but it still ends the year higher and recovers quickly in 2023.

Separately, Asian diesel margins tumbled over the last two sessions, with swaps sold off hard as the market priced in expectations of a fresh batch of export quotas from China.

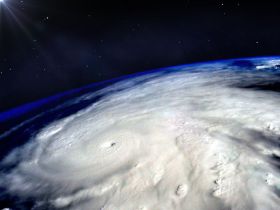

Storm

Meanwhile, weather watchers and energy traders are tracking the path of a weather system that Thursday became the sixth named storm of the 2022 Atlantic Hurricane season, which is currently moving towards the Leeward Islands.

Tropical storm Fiona is located over 700 miles east of Puerto Rico and moving to the west at 15-20 mph toward the Leeward Islands and is expected to bring torrential rains and gusty winds of 40-50 mph to the US and British Virgin Island along with Puerto Rico on Friday.

Staying in the US, the EIA reported in its latest release that commercial crude stocks climbed 0.6% (+2.4 million barrels) to a four-week high of 429.6 million barrels, around 3% above the same time last year.

US diesel stocks climbed 4.3% to just a seven-month high of 106 million barrels as demand slumped and exports slowed, while jet climbed 1.2% to a three-week high of 39 million barrels.

Distillate stocks are still 17% below their five-year average amid a global shortage of supply exacerbated by a post-Covid economic rebound.

Gasoline inventories fell to their lowest since last November at 213 million barrels as of 9 September, down 0.8% over the week and 2.3% below the same time last year.