Oil futures: Brent prices surge 4%, record natural gas set to lift oil demand

Quantum Commodity Intelligence – Crude oil futures Monday were sharply higher as prices continued to enjoy support after OPEC members flagged a potential output cut, while wranglings over details has pushed talks between Iran and the international community into next month.

Front-month October ICE Brent futures were trading at $105.29/barrel (1830 GMT), compared to Friday's settle of $100.99/b, while the more liquid Nov22 contract was trading at $103.06/b versus the previous-close of $99.01/b.

At the same time October NYMEX WTI was trading $97.25/b, versus Friday's settle of $93.06/b.

"While the macro-economic outlook remains challenging due to the lower growth outlook and recent dollar strength, crude oil and the product markets have nevertheless managed a strong rebound this past week," said Ole S Hansen, Head of Commodity Strategy at Saxo Group

Sentiment was further supported following news that Kazakhstan exports of crude may be impacted for months. Repair work on three damage moorings at its port facility may take longer than expected.

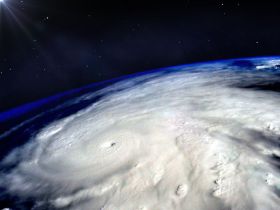

Furthermore, rising tensions in Libya and the Atlantic coming into the peak storm season also supported oil markets.

Rocketing natural gas prices continue to underpin fuels used for power generation, particularly the diesel market as both European and Asian gas prices hit record highs last week.

Front month cracks for CIF gasoil/diesel cargoes versus Brent touched $64/b last week, the highest in more than eight weeks as gas prices in Europe soared, forcing up the cost of refinery operations.

Demand

The IEA estimated that an extra 300,000 bpd will be used for power generation over the next six months, with around half of that from diesel and the other half fuel oil, although some analysts see additional demand closer to 500,000 bpd.

"High natural gas prices are pushing more power generators and industrial users to consume more diesel and fuel oil. This is part of the reason why US exports have been so strong of late," said ANZ commodity strategist Daniel Hynes.

Dutch TTF futures for Oct22 traded at a high of €348.785/MWh on Friday before settling at €346.522/MWh, while the Nov22 and Dec22 contracts both traded above €350/MWh.

North Asian benchmark JKM futures for Jan23 and Feb23 closed Friday above $80/mmBtu for the first time.

European gas prices, however, retreated by nearly 20% in Monday trade in Europe, with Goldman Sachs saying Friday the market had overshot fundamentals.

By contrast, European gasoline cracks dropped below $10/b last week for the first time since March, flagging an early end to a lacklustre driving season.

Meanwhile, Baker Hughes' latest weekly survey showed active drilling rigs in the US rose by three units to 765, following three successive falls. Drilling rigs specifically for crude oil were up by four at 605.