US DATA: API crude stocks tumble, products posts gains

Quantum Commodity Intelligence – US crude oil stocks fell sharply in the week ending 25 August, comfortably outstripping expectations, according to a report released late Tuesday by the American Petroleum Institute.

The latest API numbers revealed an 11.5 million barrel drop against analysts' expectations for a much smaller draw of around 3 million barrels, while the key Cushing storage hub, the delivery point for the WTI crude futures contract, dropped 2.23 million barrels to the lowest level since January.

The Strategic Petroleum Reserve added 600,000 barrels amid a low-scale buyback program after the Department of Energy released 180 million barrels from the SPR in 2022.

In its latest purchase tender, the DOE passed on the opportunity to buy a further 6 million barrels of crude for the SPR, as US oil prices rallied to around $10/b above the government's target price of $67-$72/b

The drop in crude inventories boosted oil benchmarks WTI and Brent futures in early Wednesday activity, although concerns over the wider global economy countered gains.

The bullish draw on crude was partially offset by a 1.4 million bpd build in gasoline inventories, while distillate stocks increased 2.46 million bpd.

The weekly API report serves as a forerunner to the closely watched EIA Weekly Petroleum Status Report, which will be published at 1030 EST on Wednesday.

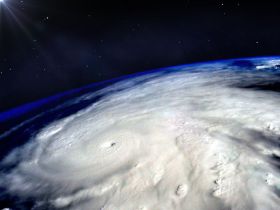

The US Gulf refining industry is currently braced for the peak of the 2023 hurricane season after largely dodging Hurricane Idalia, which is heading for landfall in the eastern Gulf and away from major energy hubs.