TABLE: Oil company profits recover, upstream output falls and run rates mixed

Quantum Commodity Intelligence - Rising oil and gas prices and recovering refining margins have helped oil companies swing into the black with positive Q2 earnings results this year and with some seeking to buy back shares as a result of increased cash flow.

Looking at Q2 results from Shell, Totalenergies, Equinor, Repsol, Cepsa and Galp oil companies globally had a positive Q2, as oil prices and global demand for oil products saw profits rise.

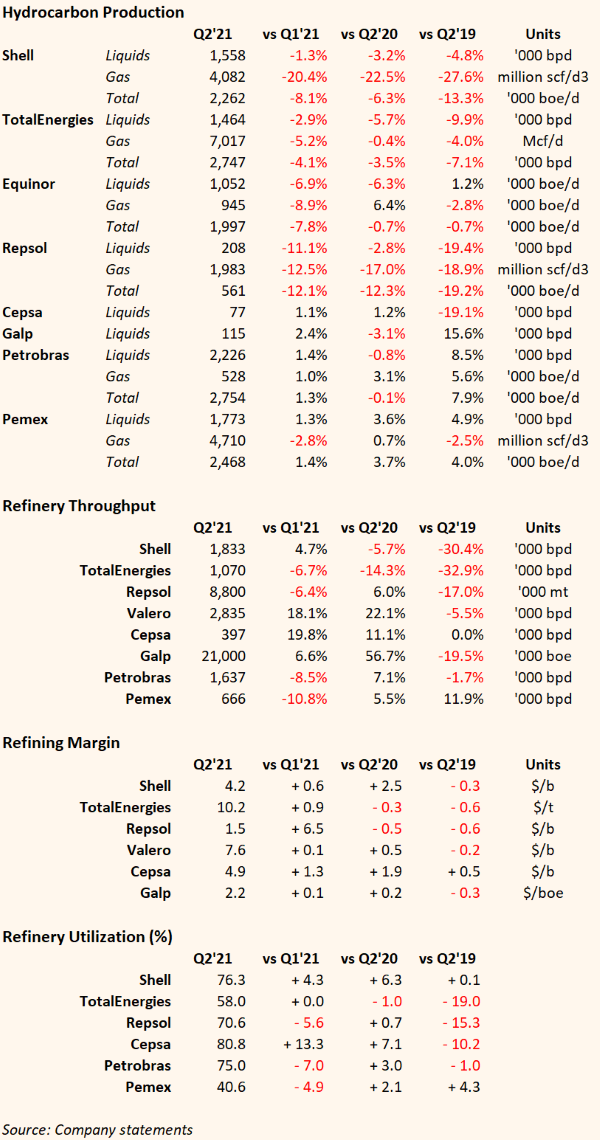

The picture painted by the results season is one of lower output and better profits.

Refinery utilisation rates were mixed, but margins were universally higher.

Hydrocarbon production also largely fell, on a quarterly basis as well as compared to Q2 periods for 2020 and 2019.

Posting the biggest jump in results on the year was Shell, which reported an income of $5.5 billion, up from a loss of $18.1 billion in Q2 last year.

TotalEnergies also reported an adjusted income of $3.6 billion in Q2, up from just $126 million last year, while Repsol turned results around posting a $579 million adjusted net income, compared to a loss of $306 million in the same period 2020.

TotalEnergies, Shell and Petrobras have stated intent to buy back shares, while Repsol said it may bring forward its buyback programme if oil prices stay above $50/b.

Below is a snapshot of their operational performance in the last quarter.