Satellite technology unlikely to boost carbon credit supply - panel

Quantum Commodity Intelligence - New technology such as satellite remote sensing can help speed up the development and monitoring of emission reduction projects but are unlikely on their own to bring a new wave of supplies to market, according to a panel of specialists on Wednesday.

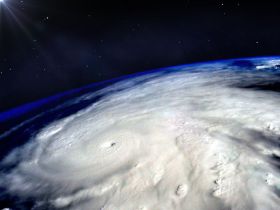

Satellite imagery, which used to be reserved to the world's militaries, has seen a boom in civilian investments in the past decade and is becoming more readily available to monitor industrial projects or the evolution of forests on the ground.

Carbon standards Verra and Gold Standard have said they are open in principle to incorporate these new technologies into the project certification process but are still assessing their potential at the time of writing.

A range of startups has been created in the past few years, hoping to cash in on their skill in extracting data from optical and radar signals.

Most of the focus currently is on emission reduction projects in the forestry sector, where satellites can be used to monitor the stock of carbon on the ground and loss events such as fires or disease.

Some startups, such as Geotree, are working directly with project operators to assess the most suitable sites for development. Others, such as Descartes Labs, have partnered with big corporates keen to understand the impact of deforestation on their supply chains.

Kayrros, a French startup, has set up a global monitoring tool for methane leaking from pipelines and industrial facilities.

All of them are relying on a mix of open-source data from government agencies - mostly NASA and the European Space Agency - as well as private operators selling their data.

"We add transparency and accountability at times when people talk about greenwashing. Our technology can provide irrefutable unbiased evidence," Mariam Crichton, managing director at 4 Earth Intelligence, told a panel at the Corporate Investments into Forestry and Biodiversity Summit.

"We don't have to talk to a company to know what they're doing. We can independently find out for an investor what's going on... It can be quite controversial in a market where everybody relies on second-party opinions and assumptions."

Compared with traditional survey methods, remote sensing can be conducted automatically by computers and is global in scale, making it much cheaper and more complete.

Areas that may be difficult for surveyors to access can be monitored remotely, thus significantly boosting capabilities.

Clear limitations

However, remote sensing also suffers from clear limitations, which have reduced its uptake to date.

For a start, forestry projects only make up a portion of the project pipeline but currently seem to be the most relevant application case.

Elias Ayrey, a remote sensing expert and former head scientist at one of the largest startups in the space, Pachama, is critical about the technology.

In a recent video posted online, he says startups promise universal coverage and almost complete accuracy but, in practice, are only able to provide rough estimates of a forest project's carbon stock as they lack access to field data.

At the moment, he says there is not enough volume of satellite data for deep learning algorithms to work at scale.

The best images tend to come from private providers, which sell them at steep premiums. Data availability is likely to skyrocket in the next few years thanks to the launch of smaller satellites that are a lot cheaper.

Craig Mills, CEO of Vizzuality, says that satellite insights "require a huge amount of knowledge and data... There is simply not enough information out there. There are huge gaps."

Supply boost

Voluntary carbon markets are widely acknowledged to face a shortage of supply, which explains the significant rise in prices seen in the past year.

Quantum assessed VCS CORSIA Solar/Wind/Waste to Energy 2016+ 20kt at $6.52/tCO2e Tuesday, up from $1.56 on the same day in 2021.

New forestry projects can take between three to five years to develop and would benefit from a technology boost.

But panellists agreed the technology is only likely to offer marginal benefits.

"A standard isn't just a methodology. We have to address the issues of project boundary, additionality, baseline scenario, monitoring of procedures and then the quantification of outcomes in a standardised way," said Verra's Julianne Baroody.

"No tech platform can take a picture of a forest and know what the baseline of that forest is. It can't tell you what would have happened in the absence of an intervention on that site."

Verra acknowledges efficiencies can be gained and certification streamlined so that more carbon projects can come onstream but says it remains committed to its current set of standards and processes.

Edward Hewitt from Respira said that more efficient certification should not come at the expense of project quality.

"There's been some frustration about the time it takes to certify a project. For sure, it could be streamlined, but we need to make sure we don't let the quality slip as this is what this market is all about," he said.