Oil futures: Prices retreat from highs after EIA stock release, Iran oil clampdown

Quantum Commodity Intelligence - Crude oil futures Wednesday retreated sharply from earlier highs as US inventory data from the EIA failed to replicate the fall in US gasoline inventories reported by the API a day earlier.

Front-month July ICE Brent futures were trading at $113.68/b (1755 GMT), compared to Tuesday's settle of $113.56/b but off from the day's high of $115.30/b.

At the same time, July NYMEX WTI was trading $109.98/b, versus Tuesday's settle of $109.77/b and off from the daily high of $111.68/b.

The Energy Information Administration reported crude inventories down 1.019 million/b, gasoline down 0.5 million/b and distillates +1.7 million/b.

The figures were more bearish than those reported by the American Petroleum Institute (API), which showed a 0.57 million barrel build in crude stocks last week. Gasoline inventories dropped 4.22 million barrels, and distillate stocks were down 0.95 million barrels.

However, the small drop in EIA gasoline figures came against a backdrop of soaring refinery utilization rates, including the key US Gulf region maxed out on capacity.

Prices also retreated Wednesday on reports that the US was set to tighten sanctions enforcement against Iranian oil smuggling, which was seen as further souring relations between Tehran and Washington.

Traders had focused on the already-tight gasoline markets for much of the day as the US heads into the summer driving season with the upcoming Memorial Day.

"API numbers overnight were once again supportive for the market. The tightening in the US gasoline market will raise concerns over supply. Tightness in the US is pulling in gasoline from elsewhere, including Europe, which is also looking increasingly tight," said Warren Patterson, head of ING's commodity strategy.

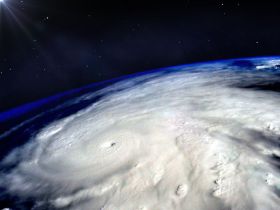

On Tuesday, US weather forecasters said the 2022 Atlantic hurricane season was expected to be above average, raising concerns that a major storm such as last year's Ida could tip the delicate supply/demand balance.

Germany's economy minister expects the EU to agree to a ban on Russian oil imports soon, with the bloc working on measures to cap price rises from previous sanctions against Moscow.

"Given the EU embargo on Russian oil is a 'when' not an 'if' question, even if Hungary fails to fall into line; it is clear that Russian exports are under pressure and will continue to be so on the back of the EU nations that support the ban," said Stephen Innes, managing partner SPI Asset Management.

France's new foreign minister also expressed confidence in a proposed EU sanctions plan that would prohibit importing Russian oil.

"We must adopt the sixth package of sanctions as soon as possible to ensure the gradual cessation of Russian oil imports and to remove any residual reservations," Catherine Colonna said.

The EU is scheduled to meet next at the end of the month to try and break the deadlock, but the laggards, led by Hungary, are pushing for concessions before backing the proposal to phase out Russian oil by the end of the year.

Even if a full agreement is not reached, shipping and insurance sanctions are set to tighten further, while most EU countries are likely to agree to a phasing out of Russian oil.