Oil futures: Crude higher as EIA reports across-the-barrel draw

Quantum Commodity Intelligence – Crude oil futures were higher Thursday as benchmarks extended the sharp rally that has lifted prices by over11% since early June.

Front-month Aug24 ICE Brent futures were trading at $85.55/b (1815 GMT), compared to Wednesday's settle of $85.07/b and consolidating at around seven-week highs.

At the same time Aug24 NYMEX WTI was trading at $81.14/b versus Wednesday's settle of $80.71/b. The Jul24 contract last traded $82.20/b heading into the expiry.

Prices have been boosted by optimism on demand growth amid broader risk-on sentiment, while OPEC+ has fully extended cuts until at least October.

Markets moved higher ahead of this week's delayed Energy Information Administration Weekly Petroleum Status Report, while an across-the-barrel draw maintained the gains, including a drop of 2.5 million barrels in crude stockpiles and 4 million barrels of combined products.

Geopolitics have also ratcheted up this week after Israel said operational plans for an offensive in Lebanon had been approved, while Hezbollah said that if Israel opens a "total war" it must prepare for attacks from the ground, the air and the sea.

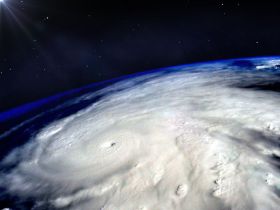

Storm

Meanwhile, Texas has issued a disaster declaration as Tropical Storm Alberto moved through the Gulf of Mexico with impacts expected to continue across the southern half of State, including much of the Texas coast through the week.

Analysts are not expecting any major disruptions for the energy markets, with any impact likely to be localised logistics as a result of flooding.

On the economic front, the pace of global rate cuts remains unclear as Fed officials keep markets guessing on the timing of monetary easing with just a single 2024 US rate cut now factored in.

Europe made its first move earlier this month, but the focus has now shifted to the timing and speed of further reductions in the deposit rate.

For Asia, ratings agency Fitch no longer expects China to cut its policy rate this year, forecasting Beijing will keep its one-year medium-term lending facility (MLF) unchanged at 2.5% before trimming it to 2.25% next year.