Oil futures: Brent holds above $85/b on demand optimism, geopolitical tension

Quantum Commodity Intelligence – Crude oil futures Wednesday were consolidating at multi-week highs on hopes of a demand-led recovery, while geopolitical tensions have ratcheted up this week.

Front-month Aug24 ICE Brent futures were trading at $85.22/b (1510 GMT), compared to Tuesday's settle of $85.33/b, which was the highest settle since late April.

At the same time Jul24 NYMEX WTI was trading at $81.48/b, versus Tuesday's settle of $81.57/b. The more liquid Aug24 contract was trading $80.63/b versus the previous settle of $80.71/b.

Markets have rallied over 10% from the early-June lows as investors buy into the summer demand growth narrative, although analysts cautioned that without signs of China picking a demand-led rally could have limited upside.

Growing tensions between Israel and Hezbollah and continued drone strikes from Ukraine on Russia's energy infrastructure have increased the risk premium, which had been largely discounted last month.

In a statement Tuesday, Israel's IDF said operational plans for an offensive in Lebanon had been approved following an intensification of cross-border fighting with the Iran-backed Hezbollah.

Adding to regional security concerns, a bulk carrier has reportedly sunk in the Red Sea after an attack by Houthi militants on 12 June.

Markets largely shrugged off data from the American Petroleum Institute showing crude stockpiles gaining 2.26 million barrels last week, going against expectations for a draw of over 2 million barrels.

OPEC+

Meanwhile, traders will be looking for signals on OPEC+ compliance after Russia, Iraq, and Kazakhstan pledged last week to rein in output and compensate for the previous overproduction.

"Kazakhstan and Russia reduced their oil production in May, albeit not enough to meet the target. However, production is at least moving in the right direction, which makes the announcement of a further reduction credible," said Carsten Fritsch of Commerzbank, but noting Iraq had failed to deliver on a previous promise.

"The situation is different when it comes to Iraq. The commitment made to OPEC+ at the beginning of May to reduce production has therefore already been made null and void," added Fritsch, referencing Baghdad's increased May output.

China also remains a thorn in the side of oil market bulls as economic data for May once again presented a mixed picture. While industrial production and retail sales data pointed to broader growth, lower crude throughputs but higher exports of refined products painted a bleaker outlook.

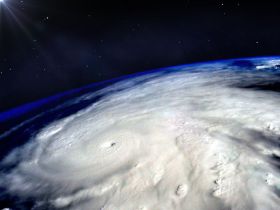

Meanwhile, a weather system in the southern Gulf of Mexico has an 80% probability of developing into a named storm within the 48 hours, the National Hurricane Center said.