Japan's crude oil stocks dip 8% in a week, implying imports fell

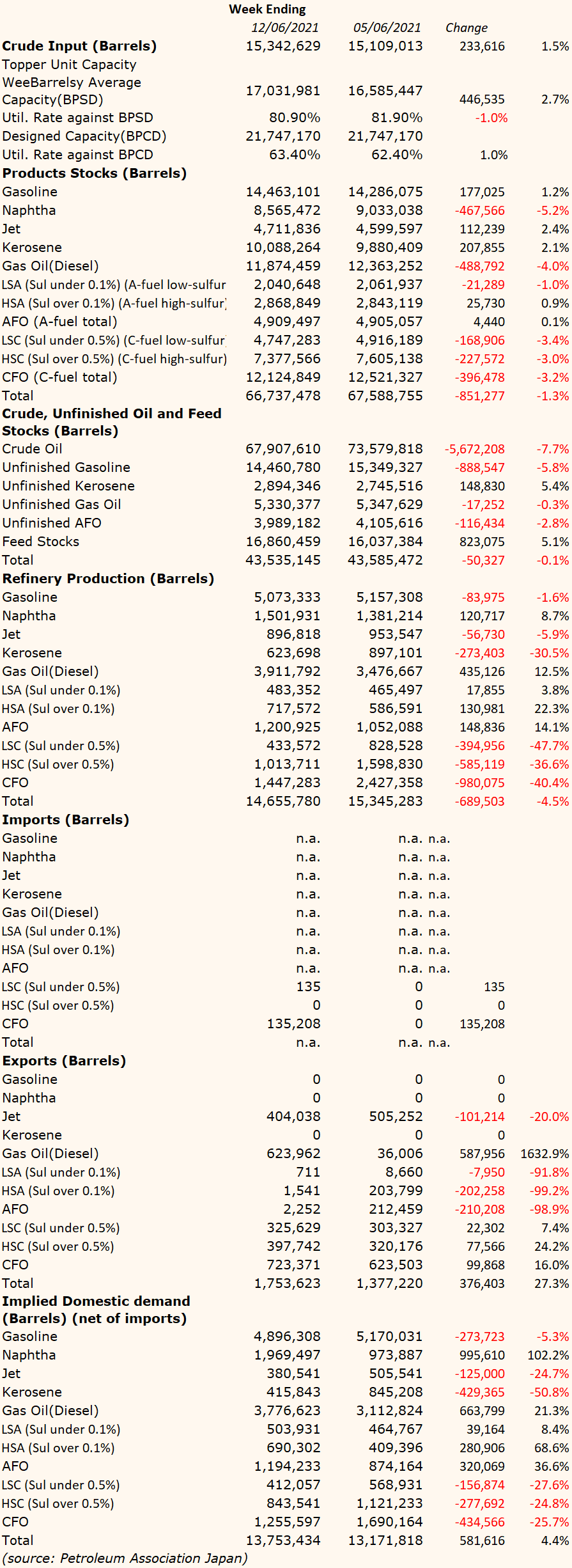

London (Quantum Commodity Intelligence) – Japan's crude oil stocks fell by 5.67 million barrels, or 7.7%, in the week ending June 12 to 67.9 million barrels, which was only partially accounted for by a small rise in refinery throughput, implying a likely substantial drop in imports that week, according to data released Wednesday, by Petroleum Association of Japan.

The country's crude imports were already showing a 28% drop to 1.95 million barrels per day in May for a total of 60.47 million barrels, according to separate data released Wednesday by the Ministry of Finance.

Utilisation rates against total designed capacity averaged 61.7% for the four weeks to June 12, a small uptick versus the prior 4 weeks, but significantly below historical rates for the same period.

Total products stocks also dipped in the week to June 12, falling 851,277 barrels on the week to 66.7 million barrels, of which diesel and naphtha fell the most as exports for diesel rose and demand for both increased.

Diesel inventories fell 488,792 barrels on the week to 11.9 million barrels despite output increasing.

This was down to a huge 587,956-barrel increase in diesel exports to 623,962 barrels and a 663,799-barrel rise in implied domestic demand, which is net of imports, to 3.8 million barrels for the week.

Meanwhile, naphtha stocks dropped 467,566 barrels to 8.6 million barrels and refinery production was up, implying a 995,610-barrel rise in domestic usage to 2 million barrels, net of imports, double a week earlier.

In line with lower local demand, gasoline, jet kero and C-fuel oil production all dropped at the expense of naphtha, diesel and the more distillate-like fuel oil type one.

Implied jet demand was 24.7% down on the week at 380,541 barrels.

In comments made Wednesday, Petroleum Association Japan's Chairman Tsutomo Sugimori forecasted an increase in refinery run rates for the second half of the year as vaccination rates continue higher and bolstered by the Tokyo Olympics next month.

Healthier export margins on refined products as the global economy recovers will also see crude input figures strengthen, he added.