JAPAN DATA: Crude intake at 6-mth high, distillate stocks hit 8-yr peak

Quantum Commodity Intelligence - Japan's crude throughput hit a six-month peak last week, although utilisation rates against available refining capacity fell slightly as the return to operation of an Eneos CDU took online capacity to the highest level since April last year, according to Petroleum Association Japan data released Wednesday.

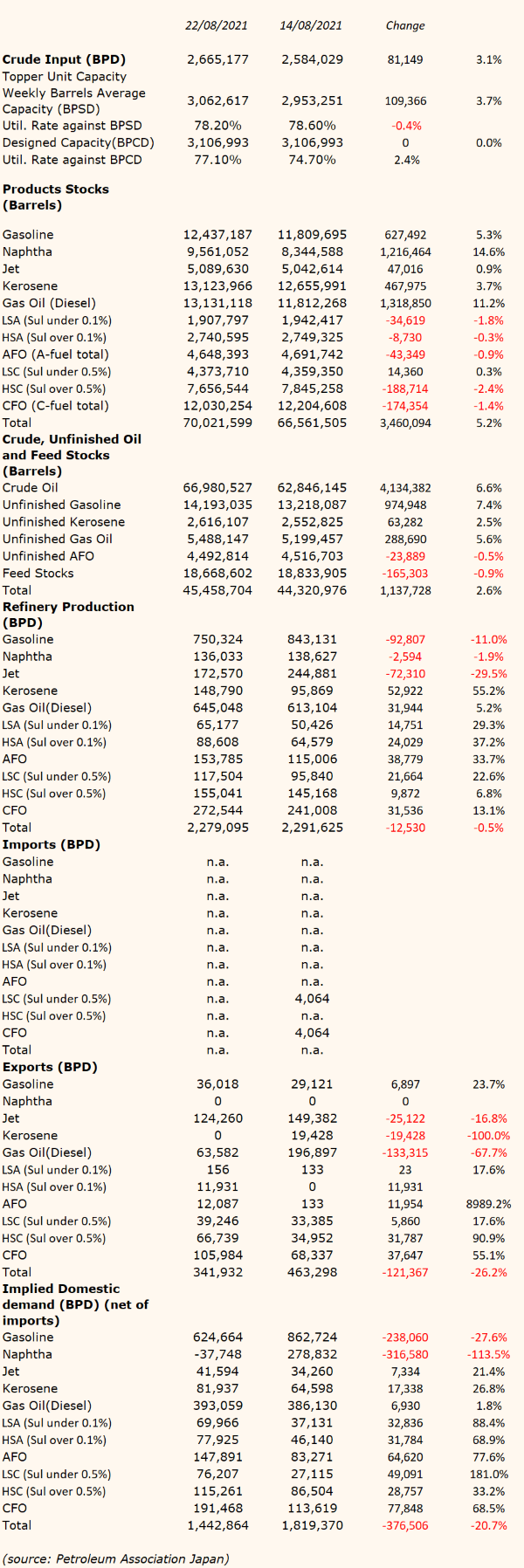

Crude input for the seven days to August 22 averaged 2.665 million barrels per day (bpd), up 3.1% on the week, but available capacity gained 3.7% to 3.062 million bpd, sending the utilisation rate down 0.4 points to 78.2%.

These were the highest figures for throughput and available capacity since weeks ending February 13 this year and April 18 last year, respectively.

Crude stocks rebounded 6.6% on the week to 66.98 million barrels even though throughput was higher after stocks had fallen to historic lows the prior week.

However, the increase in throughput came amid still worsening covid case rates which have seen states of emergency extended this week and production of finished products fell while inventory figures hit a number of record highs.

Production of finished refined products was down 0.5% to 2.279 million bpd with all of the falls seen for gasoline, naphtha and jet, while output of other products all made gains.

It appeared finished product output was reduced in favour of a stock build in unfinished product feedstocks though, for which inventories grew 2.6% to 45.459 million barrels.

The gains in output for finished products other than light ends and jet were not matched by domestic and export demand and gasoil/diesel stocks hit an eight-year high of 13.131 million barrels following an 11.2%, or 1.319 million barrel, weekly rise.

Kerosene stocks also moved to a seven-month high of 13.124 million barrels but the move was in line with seasonal expectations as inventories build towards peak winter demand.

Fuel oil stocks saw the only negative moves on the week, even though output was sharply higher likely attracted by healthy production margins on power generation demand in Asia and the Middle East.

In total, products stocks grew 2.6% to a seven-month peak of 70.022 million barrels.

With overall refined product exports also falling, the stock gains implied a large drop in implied domestic demand for gasoline, unless imports were significantly higher over the same period.

Implied demand calculations based on PAJ figures, which do not include imports as no weekly data is made available, also left naphtha in the strange situation of 'negative' demand.

This almost certainly meant that naphtha imports were on the rise, as the negative figure followed average weekly implied demand (net of imports) of more than 200,000 bpd in the first half of August.