CHINA DATA: June product exports spike amid 4% rise in crude runs

Quantum Commodity Intelligence – China's refined product exports were sharply higher in June compared with May amid a 4% rise in refinery throughput, with China finding an outlet for surplus middle distillates to pressure refining margins for jet and diesel in Asia.

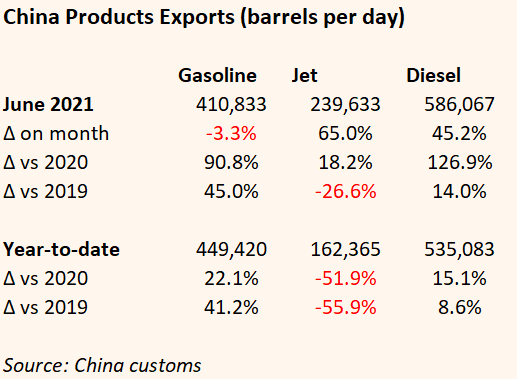

Jet exports rose 65% on the month to 240,000 barrels per day, with diesel up 45% to 586,000 bpd, more than offsetting a 3.3% drop for gasoline to 411,000 bpd, according to customs data released Sunday.

The higher exports come as crude throughput rose by about 700,000 bpd to 14.8 million bpd in June.

The jet export figure was the highest since April last year when it was 535,000 bpd, but still down by 26.6% from the pre-covid equivalent in June 2019.

Middle distillate cracks slid in June, according to Quantum data, as Covid restrictions in southeast Asia dampened demand at the same time that Chinese exports rose.

10ppm cracks on a FOB Singapore basis versus Brent slid $1.21/b over the month from $5.89/b to $4.68, with jet cracks on the same basis sliding $1.41/b from $3.29 to $1.88/b.

YTD

The export figures for the first half of the year unveil the impact China is having on the local gasoline export market as rising crude runs have seen exports of gasoline increase sharply.

In the first six months of June 2019, China exported 6.7 million mt of gasoline, rising 18% to 7.9 million mt in the same period in 2020.

However, for the first six months of 2021, that figure is up almost 20% to 9.57 million mt (449,420 bpd), a 41% increase in just two years.

For diesel, exports in the first half of this year are 14.4% up on the year before and 8.6% up on the first six months of 2019.

The rise of both ground transport fuels comes as Chinese authorities allowed independent refiners to import more crude.

And while higher runs have led to spiking gasoline exports, higher diesel exports have been curbed so far this year due to increased demand at home from the construction and mining sectors.

Jet fuel exports in the first half of the year are still less than half that in each of the last two years, as would be expected.

However, the notion of rising exports may be curtailed for the rest of the year.

Chinese oil companies are likely to slash July exports of gasoline and middle distillates to a six-year low of 1.15 million metric tonnes amid tight export quota availability and better domestic margins, according to a report published by S&P Global Platts last month.

Citing industry sources, the report added that outflows of gasoline, gasoil and jet fuel from China are likely to remain at low levels for the rest of the year.