Asia oil/products: Crude price higher, diesel cracks jump

Quantum Commodity Intelligence – Middle East crude prices Monday was cautiously higher after Russia's closure of the Nord Stream 1 pipeline helped underpin global energy prices, while diesel cracks spiked, tracking European swaps higher.

Dubai cash for November delivery was assessed at $95.34/b for 5 September (1630 Singapore time), up $0.59/b on the day, while DME Oman futures were up $0.59/b at $95.43/b for the Nov22 contract.

Market structure also consolidated the recent recovery as the key M1/M3 spread (Nov22/Jan23) climbed towards $6/b, while the one-year curve gained more $1/b to $14.81/b.

Monday's OPEC+ meeting came after the Asian market close, stifling any discussion in the spot market, while traders were also waiting for the release of Saudi's OSPs for October before entering the spot market for November.

ICE Brent futures for Nov22 were valued at $95.60/b at 1630pm Singapore, up $0.61/b from the previous Asia close, maintaining a narrow Nov22 Brent/Dubai cash spread of $0.26/b. The Nov22 EFS was slightly firmer, trading around $6.15/b at the Asian market-on-close.

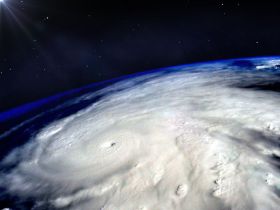

Meanwhile, super typhoon Hinnamnor was expected to make landfall in South Korea Tuesday, causing major shipping and bunkering disruptions.

Products

Naphtha cargoes were well bid by BP on Monday, with the energy major seeking an H1 naphtha parcel at $665/mt CIF, or flat to swaps. That's up from a discount last week. Physical cracks on the day were broadly unchanged, although the paper lost ground to crude.

Gasoline cracks jumped a dollar and are now near a one-week high as the market corrected from negative territory and the backwardation firmed significantly. Q4 cracks are now at $1.67/b versus about -$2/b last week. The market is getting tighter. September-October swap spread is now at almost $3/b versus closer to $2/b last week. In the physical market the cash differential rose and was assessed at just under $2/b. One trade for 15-20 days for RON 92 loading was heard with a bid at $2.60/b above paper being hit. Later dated bids were closer to $1/b above swaps. RON 95 was bid and offered at $2.60/b versus $3.50/b over 95 swaps and at a flat price of $104.30/b for prompt loading. Quantum assessed at $100.46/b FOB Singapore for RON 92, the benchmark grade.

Jet was bid by both CAOSG and Petrochina, with the former seeking a 15-20 day parcel at $2.60/b above swaps and the latter at $1.88/b for a cargo loading out of Singapore between 20-25 days forward. That pushed up the cash differential due to the steeper backwardation in the physical from $1.90 last Friday to $2.14/b on Monday, giving a flat price of $137.10/b FOB Singapore, up $4.05/b on the day. Jet outpaced diesel to narrow the regrade for September to -$7/b from -$7.40/b on Friday. The east-west for October was pegged at -$87.50/mt, close to arb levels.

Diesel paper cracks jumped with Q4 at $41/b, up $3/b from Friday. That rise lagged the move in Europe and the EFS for October widened more than $7/mt on the day to -$52.6/mt, although the arb remains shut from Singapore. In the physical market, Vitol was bidding at $1.50/b over swaps and BP, Shell and Unipec were offering. One deal was heard with Vitol hitting BP's offer at $1.30/b above swaps for a parcel loading 15-20 days forward, a value equivalent to $143.16/b FOB at 1630 Singapore time. BP was offering later dated parcels at $1.6/b above swaps, indicating the backwardation was flattening. Elsewhere 500ppm traded at $3.80/b under 10ppm swaps and 0.25% cargo was bid at a $5.40/b discount. Sulfur spreads are widening.

Marine fuel was bid at a $2/mt discount to swaps and offered at flat, betraying the weakness in the market as Singapore remains awash with local and Russian supply of 0.5%. The cash differential was assessed at $0.09/mt over swaps. The backwardation is crunching in with September at $3/mt over October, down from an $8/mt premium last week. Cargoes were assessed at $678.67/mt, up $14.34/mt on the day, with the crack pegged at $3/b, up $1.59/b on the day on a 6.9 density basis.

Unlike marine fuel, HSFO, and particularly, 180cst fuel oil, the main grade for power stations, was bid steadily higher, with Vitol bidding for a cargo loading 15-20 days forward at $8/mt above swaps. That was hit by Gunvor and raised the assessed cash differential to $7.11/b amid backwardation in the physical market. The flat price was assessed at $461.47/mt, rebounding from an eight-month low. Cracks remain weak, however, due to high run rates. Higher viscosity 380cst was also bid firmer at $3/mt with Petrochina bidding all laycans in the 15-30 day range. That pushed up the cash differential to $3.25/mt and a flat price of $428.46/mt, up $5/mt on the day.